How to invest in gold?

Why invest in gold? What are the benefits of gold and in what form should you buy it? Although gold has asserted itself as the best investment, it is not always easy to make your first purchase.

Why buy gold?

If you are wondering this, it means you are already interested in gold… and you’re not alone! Gold is of interest for multiple reasons.

Firstly, it is an instrument that has retained its value over the centuries. Can the same be said of fiat currencies? Although just a few decades old, they are gradually losing value, eaten away by inflation. But for gold, the opposite is true! In fact, between 1998 and 2008, as the value of the dollar weakened tremendously in the face of other currencies, the value of gold rose by 212%. It should also be said that, when people lose confidence in their currency, they would rather turn to an asset whose intrinsic value remains steadfast and does not deteriorate.

Not to mention the fact that this upsurge did not end there: in 2011, during the European crises, the price of gold increased to $1,825 per ounce, and for good reason. The golden metal is called a ‘safe haven’ because its strength multiplies in times of crisis. When geopolitical uncertainty takes hold, when banks are going bankrupt, when inflation devalues your savings and so on, gold protects you.

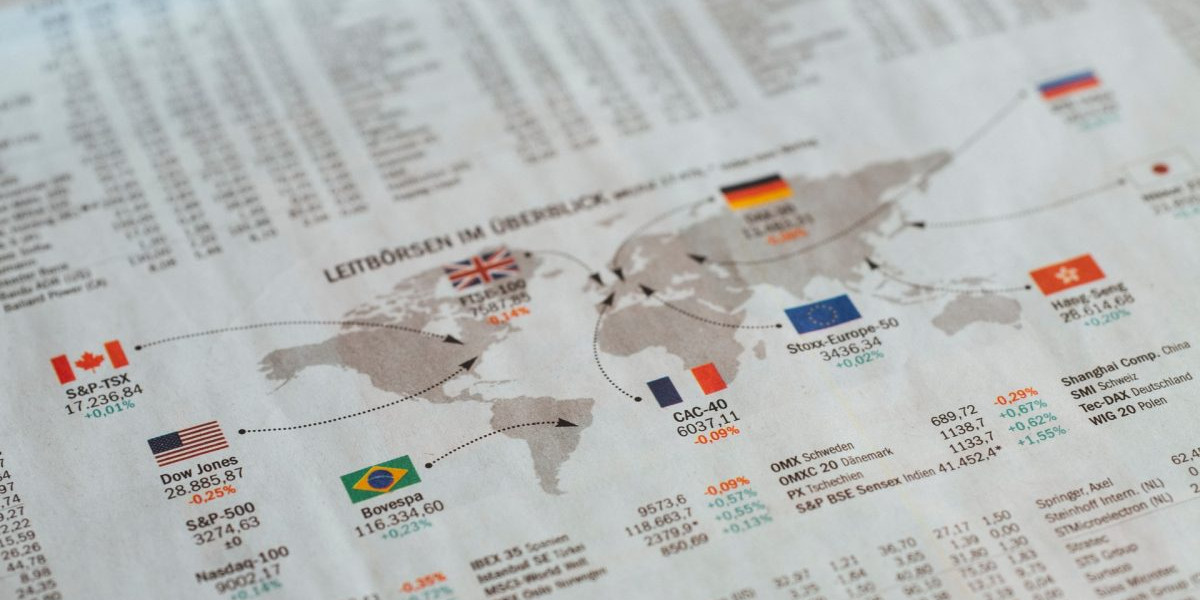

Lastly, it is also appealing to people who are interested in diversifying their assets, because there is no correlation between stocks/other financial instruments and gold. It is for that very reason that the 1970s were a great decade for gold but not for the stock market.

This is why gold is said to be a safe investment, meaning one whose value is maintained, or even increases, in the event of a financial crisis. Unlike other assets that can collapse during periods of economic and political instability, gold is a fairly low-risk, reassuring investment, ideal for diversifying your savings and securing a portion of your resources.

Gold as money

People tend to think of gold as ‘stationary’, buried in a chest in the garden or in the form of jewellery. But, for nearly 3,000 years, it served as a monetary instrument. And although that has not officially been the case since the Bretton Woods Agreement, VeraCash lets you use the golden metal as real money. For example, you can revive the use of gold as money with your VeraCash card—a payment card backed by your precious metals account—and peer-to-peer transfers of VeraCash.

Because it protects your buying power is a stable asset available in limited quantities (and so cannot be printed at the discretion of a central bank), it has all the qualities to make it suitable for use as money.

“You must decide […] between trusting in the natural stability of gold and the natural stability of the honesty and intelligence of the members of the government. And, with all due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold.”

George Bernard Shaw

So, yes to gold… but in what form?

While GoldSpot is more suited to consumption thanks to its underlying ingots (because they are directly indexed to the international spot rate), GoldPremium is a better fit for savings, because it enjoys a premium. The premium is the difference between the price of the precious metal contained in the coin and the price of the coin itself. It is dependent on the quality of the coin, its rarity, its size and its condition.

Lastly, another advantage of VeraCash is that you can split your gold. For example, if you want to buy gold but don’t have a big budget, no problem! On our platform, there is no minimum spend on the gold you buy, so if you only want a few grammes, that’s perfectly possible. Moreover, it can be beneficial to spread your gold purchases evenly over time, rather than buy large quantities all at once.

Although gold is a tangible metal, the type of gold you buy is not always physical… This is the case with ETCs (exchange-traded commodities), for example. ETCs are baskets of securities that reflect the price of commodities (raw materials) and are traded like stocks. As a result, if you want to own gold, they are probably not the right solution, because your ETCs will not be exchangeable for actual gold; they are merely indexed to gold. Furthermore, they pose the same risks as stocks, including volatility, risk of the company issuing the contracts defaulting, etc.

If you are interested in tangible, physical gold, we recommend that you only buy high-purity gold. Rest assured that there are lots of options. High-purity gold exists in every form: coins, tokens, nuggets, ingots, jewellery and more. And to satisfy every preference, VeraCash offers two products:

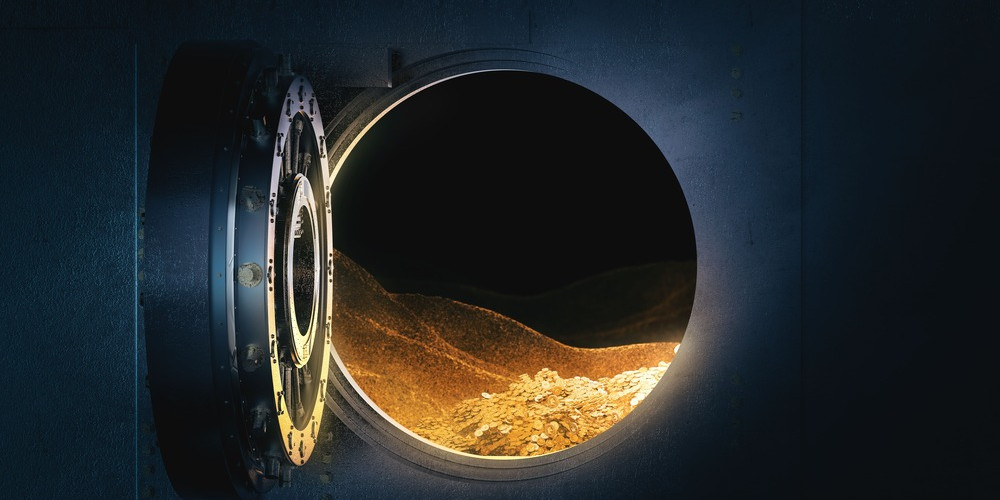

Where can you store your gold?

Gold storage is always a complicated subject. Keeping it at home means running the risk of it being stolen… or worse, forgotten! More and more organisations now offer to store your gold for you. This is the case with VeraCash, which does this at no cost to you, storing it in ultra-secure vaults at the Free Ports of Geneva.

Is now the right time to buy gold?

It is important to remember that there is no exact science for determining when to buy gold. Furthermore, we are not investment advisers: VeraCash is, first and foremost, an intermediary platform for buying gold quickly and securely. But regardless of all that, our advice to you is to spread out your purchases. Gold purchases should be planned from the perspective of protecting and safeguarding your assets in the medium to long term. So, whatever the gold rate, it is still always better to buy at a low price.