VeraCash, the gold-backed currency

Over the centuries, money has evolved, with its very nature being altered: from commodity currency to fiat currency, and now cryptocurrency. In other words, our medium of exchange has undergone radical transformation on many occasions. At VeraCash®, we believe that gold is perfect for playing the role of a monetary instrument. Let us explain why.

Benefits of gold as a currency

Souple comme une cryptomonnaie

Quelle que soit l’époque, le pays ou la situation économique, l’or a toujours été reconnu comme un métal précieux.

Sa valeur ne dépend ni d’un État, ni d’une monnaie, ni d’un groupe de personnes : elle lui est propre.

Stable comme des lingots d'or

Les monnaies se dévaluent dans le temps et un capital épargné dans une quelconque devise nécessite un taux d’intérêt pour que sa valeur compense cette dévaluation. L’or ne se dévalue jamais, c’est pourquoi même les banques centrales achètent régulièrement de l'or afin de se constituer une réserve de valeur permanente et insensible aux crises.

Éco-responsable comme une monnaie complémentaire

L’or conserve sa valeur d’échange en dépit des turbulences économiques et financières à travers le temps : un Napoléon de 20 francs or permettait d'acheter une bicyclette en 1912 et c'est toujours le cas aujourd'hui alors même que les prix ont été multipliés par 800 depuis cette époque !

L’or peut parfois générer une plus-value

Même si l’or n’a pas de rendement à proprement parler, il peut toutefois s’apprécier en temps de crise et permettre alors une plus-value à la revente suivant le prix auquel on l’a acheté ; pour information, la valeur de l’or a progressé de 8.69% par an en moyenne sur les vingt dernières années.

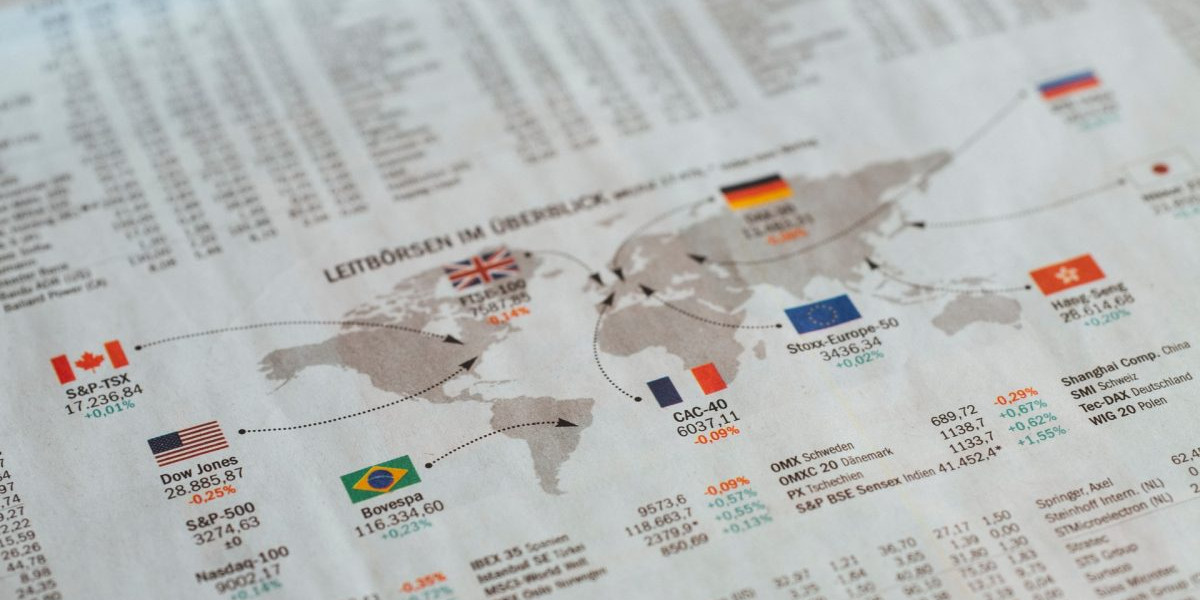

Money throughout history

Initially—and for a very long time—goods were exchanged for a product or material endowed with value. For example, although impractical, salt once served as a currency. The first materials and metals were gradually abandoned over time, in favour of paper money. At the outset, paper money could be exchanged for gold, just like the US dollar after the Bretton Woods Agreement, but it was eventually separated from its underlying asset, becoming a fiat currency.

However, it is worth noting that fiat currencies have long existed, but have been dropped time and again after bouts of hyperinflation.

How is money created?

Fiat currencies—what we use today—have no intrinsic value. Instead, their value is based solely on the trust we have in them. In other words, they have no underlying assets, and the truth is that there is very little hard cash in existence today. Our money has become completely virtualised, further facilitating its creation:

- Commercial banks which create money by granting loans.

- Central banks, like ECB and Fed, which provide the commercial banks with reserves through quantitative easing and low key interest rates.

"This is money that is declared legal tender and issued by a central bank but, unlike representative money, cannot be converted into, for example, a fixed weight of gold. It has no intrinsic value—the paper used for banknotes is in principle worthless—yet is still accepted in exchange for goods and services because people trust the central bank to keep the value of money stable over time. If central banks were to fail in this endeavour, fiat money would lose its general acceptability as a medium of exchange and its attractiveness as a store of value."

— European Central Bank

Why choose a currency backed by gold?

As mentioned above, the euro, the dollar and other currencies have no innate value. Conversely, gold and silver both take time and money to mine and mint. Their value is therefore linked to the work performed and the resources used. Gold is also available in limited quantity and is non-oxidising. Furthermore, it cannot be created from anything else, which greatly reduces the possibility of counterfeiting.

VRC, at the crossroads between different worlds

The purpose of VeraCash gold is to restore the meaning of money and to endow gold with a more modern image. Consequently, VeraCash is a hybrid digital currency:

- As flexible as a cryptocurrency: thanks to the “Send VRC” function, which lets you transfer money faster than via a bank transfer or bitcoin transaction.

- As stable as gold bullion: since you get to enjoy all the advantages of the golden metal: security, tangibility and preciousness.

- As responsible as a complementary currency: as 90% of the gold we use has been recycled and because no mining is required when sending VRC.