Gold,redefinedsavings

Across time and nearly everywhere on the planet, gold has been valued as a powerful way to build wealth: a true treasure.

With VeraCash, a new use emerges for the 21st century: savings… accessible anytime.

Why buy gold?

Gold is precious by nature

Gold has always been recognised as a precious metal, regardless of time, country or economic situation.

Its value does not depend on a state, a currency or a group of people: it is independent.

Gold enables you to store value

Currencies devalue over time and capital saved in any currency requires an interest rate to compensate for this devaluation. Gold never devalues, which is why even central banks regularly buy gold in order to build up a permanent and crisis-proof store of value.

Gold preserves purchasing power

Gold retains its exchange value despite economic and financial turbulence over time: a 20 franc gold Napoleon coin could buy a bicycle in 1912 and still can today, even though prices have increased 800 times since then!

Gold can sometimes generate a capital gain

Even if gold does not have a return, strictly speaking, it can nevertheless appreciate in times of crisis and allow for a capital gain on resale depending on the price at which it was purchased. For instance, the value of gold has risen by an average of 8.69% per year over the last twenty years.

Saving is not investing

Saving means setting aside a portion of your assets for future spending. It is not about speculating or seeking to make a profit. As such, gold has always been a particularly favoured savings instrument for all social classes throughout history.

Its use for inheritance has never been denied over the last 20 centuries, and that is thanks to its rarity and its inalterability, which guarantees it an almost eternal value.

Even today, the precious metal is one of the favourite means of saving for individuals, along with savings accounts, current accounts and life insurance. But gold also has a timeless nature that makes it similar to real estate, a true long-term haven, which makes it a solution.

How to save in gold?

Diversification must be the key word and if it is true that gold is an excellent way to secure one’s wealth, it should not constitute the main part of one’s savings. This is why all the experts agree that the proportion of gold in a portfolio should not exceed 5 to 10%, or even 15% in some cases (to be checked with one’s financial advisor). This strategy, which consists of not putting “all your eggs in one basket”, makes it possible to smooth out the performance of your savings by possibly offsetting losses in one asset with good performance in another.

How to combine security and liquidity of gold savings?

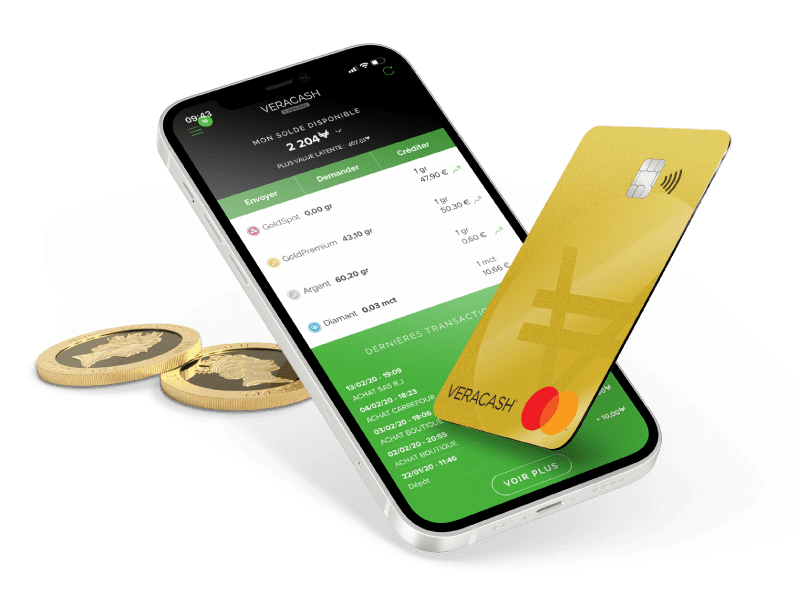

The golden rule is to turn to companies whose business it is, such as VeraCash, which offers 100% physical, LBMA-certified gold and storage outside the banking sector, in the highly secure vaults of the Geneva Free Ports and Warehouses.

With VeraCash, your gold is not only stored in a totally secure manner, but it also remains available at all times. Indeed, by combining it with a Mastercard debit card, VeraCash makes your precious metal account as liquid as a traditional savings account.

You can choose to keep your gold as a precautionary reserve in the medium or long term, or to use it for your daily payments. The debit card allows free withdrawals anywhere in the world.

VeraCash members are pleased with the service

You might be interested in

4 May 2023

How much should I spend on gold and silver?

Diversifying is about minimising the risk of capital losses that are always possible on certain products, but also and above all, to preserve the…

28 April 2023

2023, a good year for gold prices?

It's prediction time. At VeraCash, we prefer facts to predictions or magic. So to tell you about the gold price in 2023, we're going to have to tell…

21 February 2023

Could inflation be both the problem and the solution?

Rising prices are undoubtedly the indicator that speaks loudest to the most people. Depending on geographic location and position in the economic…