It’s prediction time. At VeraCash, we prefer facts to predictions or magic. So to tell you about the gold price in 2023, we’re going to have to tell you about the state of the world. When the world sneezes, gold catches a cold. When the world is stable, so is the price of gold. So, in 2023, what are we expecting for gold?

Gold in 2023, the logical continuation of 2022?

Since the start of the COVID 19 pandemic in February 2020 and the war in Ukraine in 2022, one might think that anything is possible, especially the unimaginable. But if we look at the economic and geopolitical facts of 2022, what do we see?

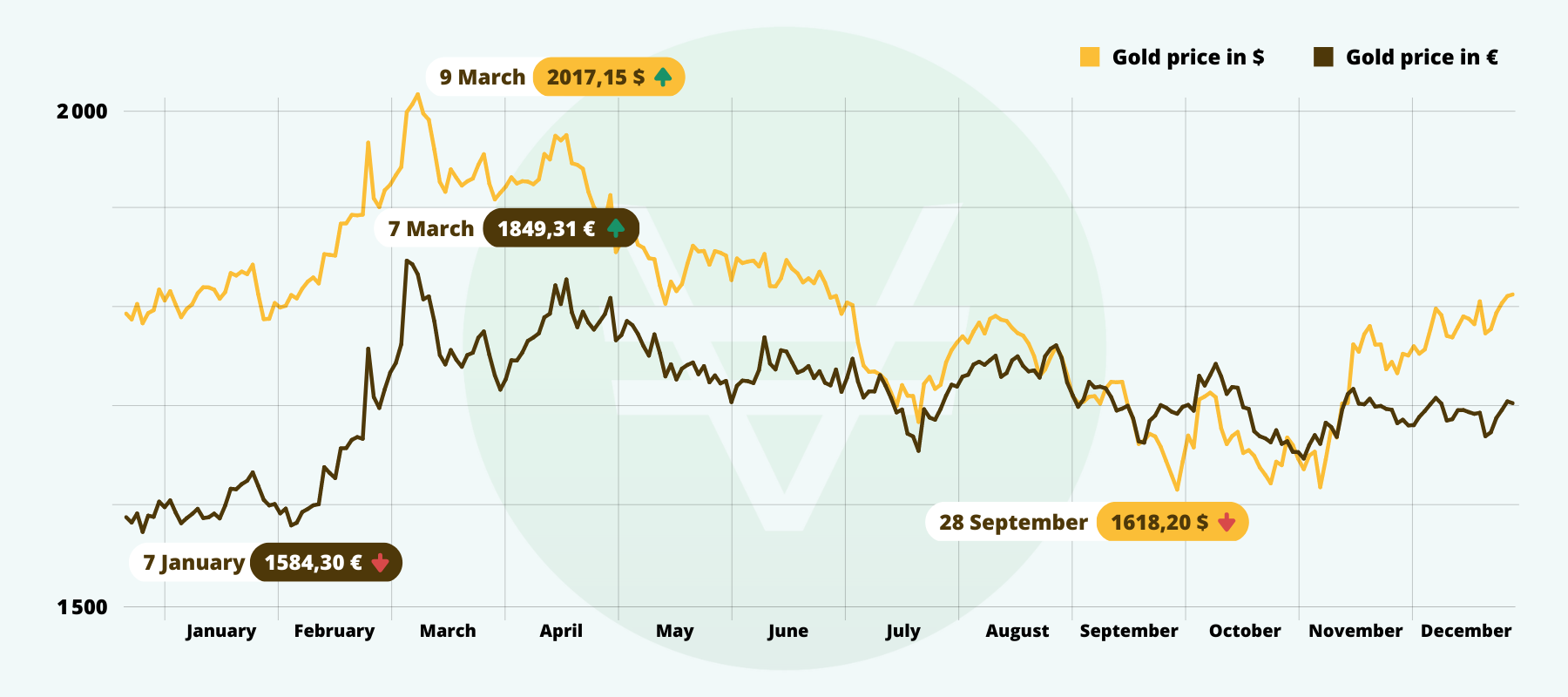

The most significant event for the gold price in 2022 was the outbreak of war in Ukraine at the end of February. At the beginning of March 2022, the gold price in euros reached an all-time high of EUR 1,800 per ounce. As the war took hold, the safe-haven effect gradually faded.

Gold prices and inflation in 2022

This is the second “Kiss Cool” effect for the gold price: inflation. Economists disagree on the reasons for this price rise (post-covid magic money or Russian conflict or both) but it has taken hold. Central banks have brought out the artillery to try to curb it. So interest rates rose sharply in 2022. Currencies were stronger, especially the dollar, so gold automatically fell in the second half. Observers also noted that in euros, the gold price ended the year 7% above its level at the beginning of the year. In dollar terms, the price of gold simply erased the rise it recorded in March with the outbreak of the war between Russia and Ukraine. So over the year 2022, the gold price on 1 January is the same as on 31 December.

In a sea of assets (stocks, real estate) which are red, 2022 is finally a rather positive year for gold.

How will the gold price behave in 2023?

A word of caution before proceeding. For the past 3 years, anything can happen and all things being equal, ceteris paribus.

How will inflation evolve in 2023?

If we look at the figures for the last quarter, inflation seems to be calming down. The year in France ends with a forecast of 6.2% inflation and rather a downward slope since September. Especially as this rise in the price index was really driven by the price of energy, oil, gas and electricity. Tensions in this market seem to be easing: nuclear power plants are coming back on line and winter was rather mild. Some economists believe that inflation could return to pre-2022 levels (2%) if Russia and Ukraine stop their conflict. It is not clear how at the moment.

Rising interest rates in 2023 work against gold

This is the other element that will play on the gold price. As we have seen, when central banks raise interest rates, gold prices fall. To be precise: it is the currencies that strengthen, so the price of gold automatically falls. In addition, government bonds and treasury bills are gaining in value with higher interest rates. In recent years, even negative rates have been recorded.

Will interest rates “peak” in 2023?

This is the news that has already been anticipated by investors at the end of 2022. For many analysts, central banks will not be able to raise their rates much further. Unless the economic cycle really seizes up and a housing crisis is triggered, which is not the objective either. Inflation is likely to remain somewhat high (unless the war in Ukraine ends), and the price of gold should benefit from this.

Find regularly updated gold prices on the VeraCash website

A gold price of $3,000 by 2023?

The news is everywhere, there is no hiding it. A Saxo Bank analyst has forecast that gold could trade at $3,000 an ounce. If (and only if) catastrophic conditions are met: a major economic crisis, runaway inflation, etc. According to this commodity market expert, if everything goes very wrong, gold will do well. A kind of safe haven, then?

Will gold rise in 2023?

Jean-François Faure (CEO of the AuCOFFRE group, of which VeraCash is a subsidiary), believes in ‘Le Revenu’ that gold will follow the trend recorded at the end of the year especially if inflation takes hold. As stated above, “all things being equal”. That is to say, if there is no unforeseeable or unthinkable catastrophe or major geopolitical unrest in the coming months.

I have been a web entrepreneur since 1999. After graduating from the Bordeaux School of Journalism, I was a radio reporter for 10 years. I run several social media and blogs on business, tech, finance and digital marketing.

You might be interested in

4 May 2023

How much should I spend on gold and silver?

Diversifying is about minimising the risk of capital losses that are always possible on certain products, but also and above all, to preserve the…

21 February 2023

Could inflation be both the problem and the solution?

Rising prices are undoubtedly the indicator that speaks loudest to the most people. Depending on geographic location and position in the economic…

23 December 2021

Do we really need to choose between physical gold and bitcoin (BTC) ?

Behind the story, which some might see as the umpteenth telling of the battle between old and young, we can discern the collision of two economic…