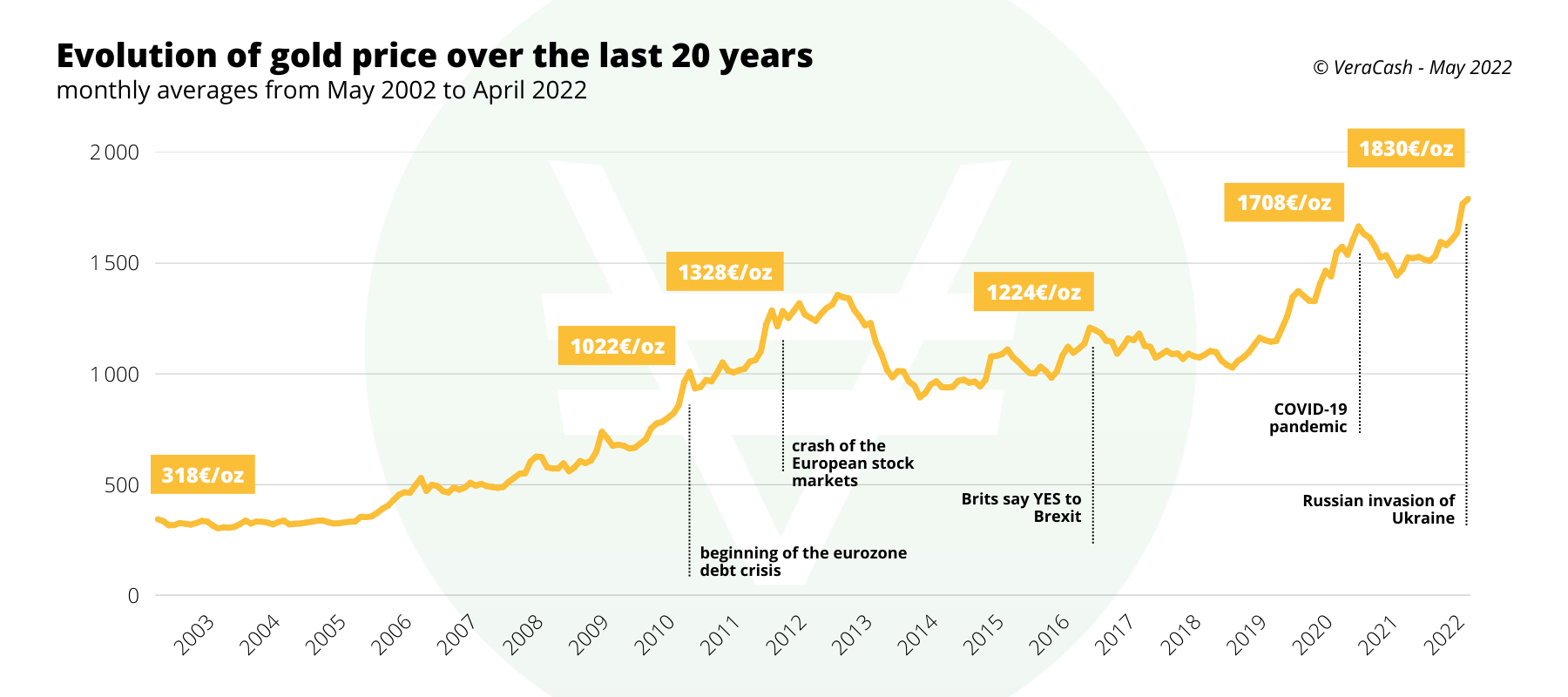

The price of gold got off to a slow start in the decade of the 2000s, but it had already begun its inevitable rise by 2002. Over the past two decades, the price of gold—by the ounce, in bars or in investment coins, such as the Napoleon—has continued to climb. In fact, from 200 to 2020, we have witnessed a 400% increase in its euro worth! Let’s take a look back at these two roaring decades for gold!

February 2020: new records for the price of gold

Unlike the previous decade, trends in the price of gold did not run counter to the different stock market closing prices. In fact, the Dow Jones and CAC 40 market indexes were at the top of their game… just like the price of gold. Gold history was made on Monday 24 February 2020, when—for the first time ever—the price per ounce was recorded at EUR 1,553 – or EUR 49.93 per gramme.

Prices on the rise for 20 years

After decades of stability, the price of gold fluctuated considerably in the past 40 years.

The seeds of America’s economic collapse were already in place at the beginning of the 2000s. The bursting of the tech bubble, the trauma from the destruction of the Twin Towers, excessive international competition, and more, all prompted the US public authorities to get creative in order to avoid worse. The ready-made solution was to stimulate the real estate market by means of staggering money creation, slashing interest rates to very attractive levels. Economic growth and employment were going full steam ahead, albeit with the usual inflationary corollary (decline in the value of the dollar). In other words, there were several factors underlying the rise of gold:

- The Weakening of the dollar, the currency in which gold is expressed

- Very sustained demand for gold from countries with growing middle classes

- Insufficient supply as inventories were exhausted.

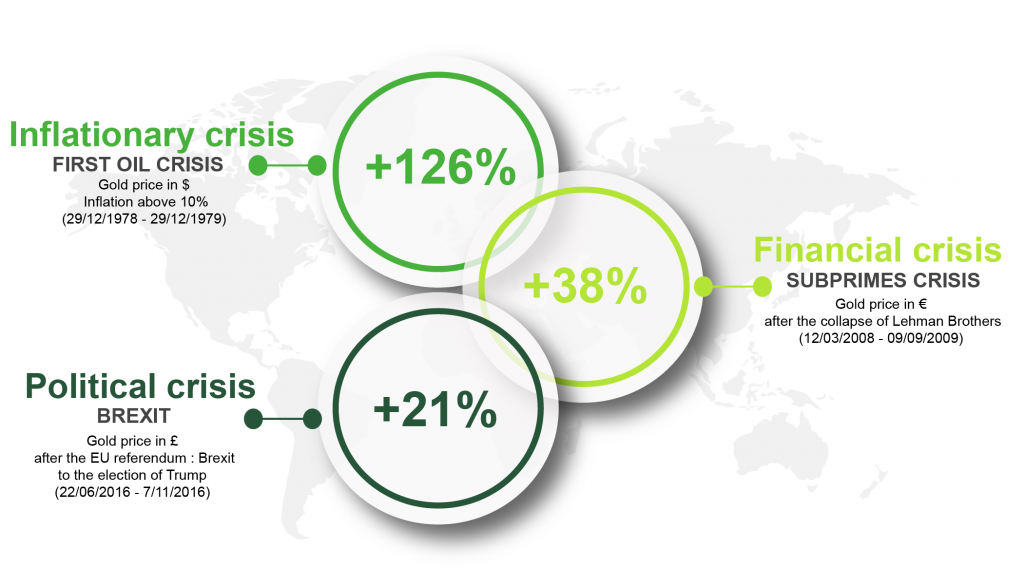

Over the past 11 years, there have been many additional factors that have bolstered the price of gold: two crashes (the tech bubble in 2001 and the stock market crash of 2008), the subprime crisis, bank failures (along with the collapse of Lehman Brothers), fear of inflation, the European sovereign debt crisis, and so on. All dramatic events contribute to rises in the value of gold—with people fighting over it during crisis periods—and risk aversion is another factor.

Gold is seen as the safe haven investment par excellence, making it the asset that all investors, savers and central banks want to stockpile when the economy and finance begin to waver. All it takes is one or two detonators in an explosive atmosphere to trigger a new gold rush.

Gold over the 20 past years

From 2018 to the present: gold prices in euros back on the rise

In the first few months of 2018, the central banks of several countries took advantage of this to increase their gold reserves. According to the World Gold Council’s report on the first half of 2018, more than 190 tonnes of the precious metal were added to the coffers of national institutions. This was an 8% increase on the same period in 2017. Most of those states wanted to lessen their dependence on the dollar or simply diversify their monetary guarantees.

In 2018, the price of gold was at its lowest, at a time when stock markets were closing at their highest. The Dow Jones fell on 4 October 2018 and later crumbled throughout the month of December. This was the worst December since the creation of market indexes. At the completely opposite end of the spectrum, it was at this same time that the price of gold swung upwards.

The prices of both shares and gold then spiked between January and August of 2019. Over the course of seven months, the price of gold climbed by 30%, equalling and breaking the 2012 record several times.

February 2020: new records for the price of gold

Unlike the previous decade, trends in the price of gold did not run counter to the different stock market closing prices. In fact, the Dow Jones and CAC 40 market indexes were at the top of their game… just like the price of gold. Gold history was made on Monday 24 February 2020, when—for the first time ever—the price per ounce was recorded at EUR 1,553 – or EUR 49.93 per gramme.

Prices on the rise for 20 years

After decades of stability, the price of gold fluctuated considerably in the past 40 years.

The seeds of America’s economic collapse were already in place at the beginning of the 2000s. The bursting of the tech bubble, the trauma from the destruction of the Twin Towers, excessive international competition, and more, all prompted the US public authorities to get creative in order to avoid worse. The ready-made solution was to stimulate the real estate market by means of staggering money creation, slashing interest rates to very attractive levels. Economic growth and employment were going full steam ahead, albeit with the usual inflationary corollary (decline in the value of the dollar). In other words, there were several factors underlying the rise of gold:

- The Weakening of the dollar, the currency in which gold is expressed

- Very sustained demand for gold from countries with growing middle classes

- Insufficient supply as inventories were exhausted.

Over the past 11 years, there have been many additional factors that have bolstered the price of gold: two crashes (the tech bubble in 2001 and the stock market crash of 2008), the subprime crisis, bank failures (along with the collapse of Lehman Brothers), fear of inflation, the European sovereign debt crisis, and so on. All dramatic events contribute to rises in the value of gold—with people fighting over it during crisis periods—and risk aversion is another factor.

Gold is seen as the safe haven investment par excellence, making it the asset that all investors, savers and central banks want to stockpile when the economy and finance begin to waver. All it takes is one or two detonators in an explosive atmosphere to trigger a new gold rush.

Nicolas a rejoint le groupe AuCOFFRE en tant que Responsable Marketing. Depuis 2016, il participe au développement de Veracash. Aujourd'hui Directeur opérationnel, il coordonne les différents services et applique la stratégie.