This article does not constitute investment advice, an activity reserved for professionals recognised by the regulatory authorities.

In times of uncertainty, people tend to reduce their consumption and increase their savings. But not just any old way, because while French savers are normally cautious by nature, they become particularly wary when the economic outlook darkens. And that’s precisely when so-called “risk-free” or “guaranteed” investments see their inflows literally explode. Except that, from savings books (Livret A) to life insurance, deposit accounts, savings plans and even cash, none of these solutions is really risk-free. Worse still, some of these tools will even cause you to lose money almost every time.

Risk in proportion to profitability

No matter how many times it’s been said, many people still haven’t realised that risk follows profitability, and that you can’t have the latter without the former. In other words, the more profitable an investment is, the riskier it is; anyone trying to sell an investment that is both highly profitable and risk-free is either a fool or a fraud. And as there are very few fools who go into the business of selling financial products… So be extremely wary of those who might offer you the deal “that financial professionals would like to keep to themselves” or the investment “that makes bankers tremble”.

Be that as it may, it is perfectly acceptable to assume a minimum of risk in return for a certain level of profitability. This is the case, for example, with SCPIs in France, which can offer a return several times higher than the rate of growth (or inflation), provided you accept the possibility of losing a little money if the markets turn unfavourably.

You can also choose to focus on the security of your capital, even if it means gaining little or nothing, the primary objective being to lose nothing. The ultimate wealth strategy is to keep all your capital in one or more demand deposit accounts, also known simply as current accounts (although they are not quite the same thing). No return, of course, but the sums deposited are theoretically recoverable in full.

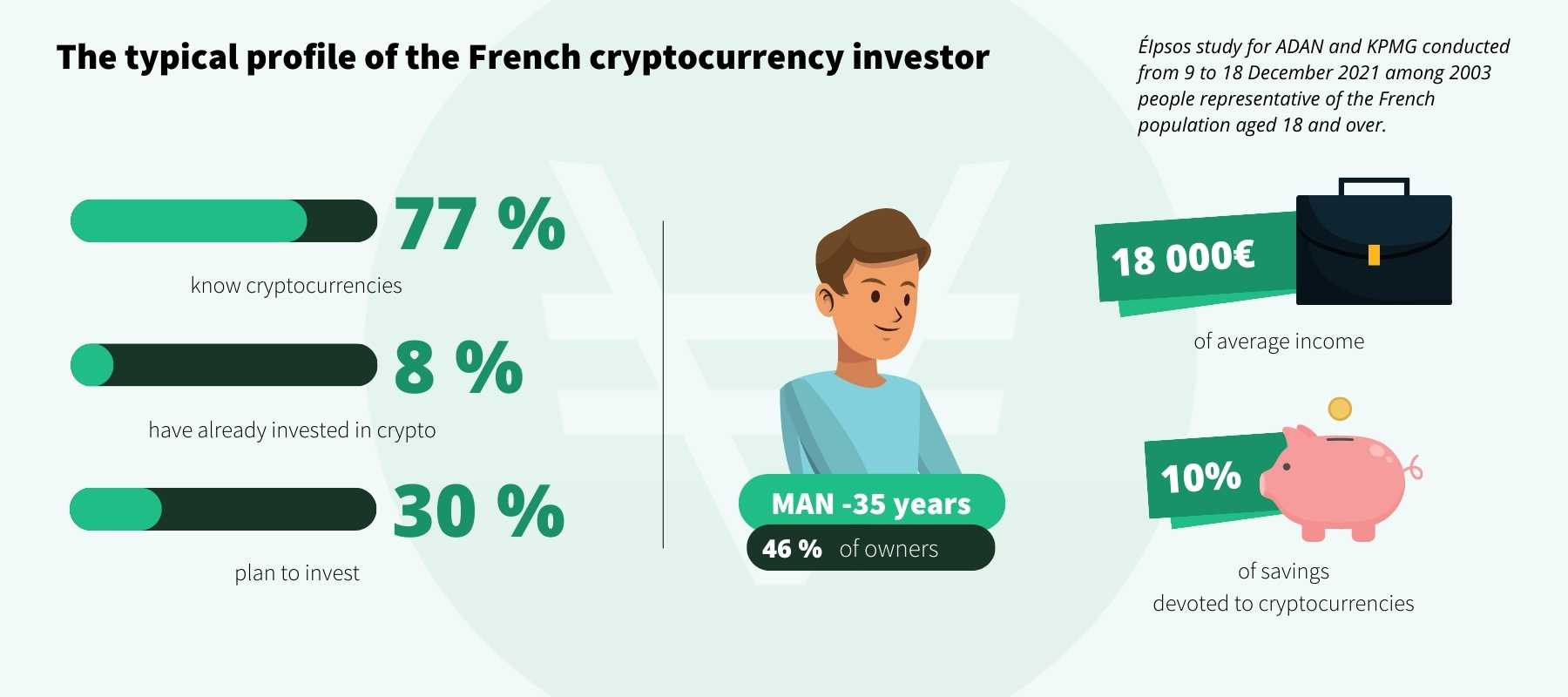

At the other end of the spectrum, there are purely speculative investments that are more akin to casinos or lotteries. Here, the only important thing is the possibility of maximum return, with no regard for risk. Trading on the stock market, investing in companies (also known as private equity) and, especially in recent years, crypto-assets (Bitcoin, NFT, etc.) are all solutions that can generate a lot of money… but can also lead to major losses, or even outright ruin for the least cautious (or greediest) savers.

Between the two, there are products that are well known to individuals, some of which have even become the favourite investments of the French. These are, of course, passbook savings accounts (Livret A) and life insurance, two savings solutions touted as being both risk-free and yielding high returns. Together with tax-free savings plans and passbooks (the Sustainable and Solidarity Development Booklet (LDDS), the People’s Savings Booklet (LEP), the Young Booklet, the Housing Savings Plan (PEL) and the CEL (Home Savings Account, etc.), these are the perfect products, combining capital security with a (small) return. A fair balance, so to speak.

The reality is more nuanced, and even these investments that we imagine being risk-free often expose us to significant financial losses.

No investment is truly risk-free

The first distinction that needs to be made concerns the assessment of risk itself. The notion of risk does not necessarily have the same definition for everyone. While some savers fear above all the loss of purchasing power of their capital, others will see the risk more in the immobilisation of their assets or in the reliability of their financial intermediary. Generally speaking, and more particularly when it comes to finance, there is ALWAYS a risk. The safest products are simply those designed to minimise the risk of capital loss.

Among the risks that persist despite all the precautions, we can refer to the liquidity risk. It is an inherent part of certain savings products whose operation involves blocking capital for a relatively long period, with no possibility of withdrawal (retirement savings, or PER, for example). There is also the counterparty risk, with the possibility that the financial operator, bank or insurance company, might go bankrupt or become totally insolvent. Finally, we must not forget inflation, which has a direct impact on all investments. This includes so-called risk-free investments, which not only affect their potential profitability, but sometimes even directly reduce the value of the capital invested.

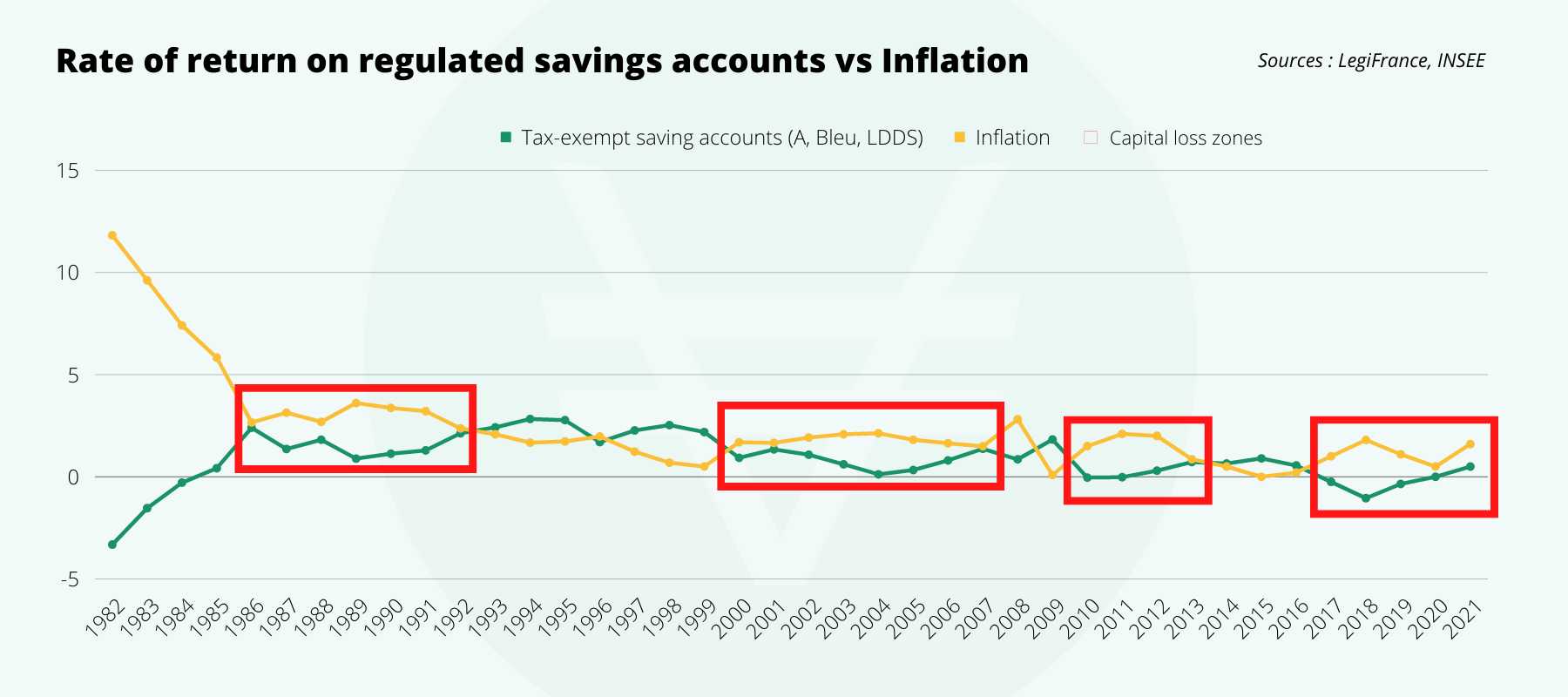

This is particularly true of all investments whose interest rate is lower than the rate of inflation. More specifically, savings accounts (Livret A) and life insurance, whose returns in recent years have been increasingly negligible in the face of price rises that are now reaching record levels. And needless to say, money merely deposited in a current account simply sees its value fall from the very beginning, in proportion to the normal rise in the cost of living. So, even with an interest rate now set at 1% per annum, the savings account (Livret A) exposes savers to a net loss of 4% of the value of their capital because of inflation, which is currently running at around 5% in France. The same goes for euro-based life insurance, which is touted as being safer than its smaller sister in unit-linked products (in this case, ‘shares’), but which on average offers a return barely higher than that of the savings account. And that’s without taking into account the social security contributions that apply in the event of withdrawal.

There is another, more subtle risk to life insurance, linked to management fees. Insurers have got into the habit of charging a percentage of the actual return on their products. However, when the return is no longer there, the management fees naturally fall to zero or almost zero. This is an unsustainable situation, and many companies have decided to counter it by changing the way their management fees are calculated, so that they are now based on the capital invested (and no longer on the capital gain achieved). As a result, even in the event of a zero or even negative return, their customers’ savings are gradually being eaten up by management fees, with no regard for the notion of “guaranteed capital”.

It should be noted that this phenomenon also occurs on a much simpler type of account, the current account, which is most often associated with a package offered by the bank in return for the annual payment of account management fees.

What about so-called safe havens?

You might say that the solution is to convert your capital into tangible assets whose value rises with inflation and which are unlikely to disappear over time. This is particularly true of real estate and precious metals. While these assets offer no significant return (or even no return in the case of gold, for example), they do offer the possibility of preserving the value of your capital and increasing its purchasing power over time, as inflation erodes the value of monetary currency. This is why they are known as “safe havens”: currencies may be devalued, stock markets may collapse, and the entire economy may disappear in a major crisis. However, a building will always remain a place of refuge and a gold or silver coin will always retain its universally recognised exchange value.

In a more traditional situation, i.e. with an economy that is progressing year on year without excessive speed but without any real major crisis either (despite the apocalypse theorists), this type of asset is very important in a balanced portfolio. It offers great resilience to temporary turbulence and provides at least a partial guarantee of the integrity of your capital.

However, here again, we cannot talk about 100% ‘guaranteed capital’ or even risk-free investments, because safe havens are also subject to certain unavoidable, although limited, hazards. For example, while the yield on a rental property may be adversely affected by a prolonged period of vacancy or even by unpaid rent, the value of the property itself may also fall as a result, of damage to the property or a downturn in the market (property crash) or, for example downgrading of the geographical area in which the property is located (impoverishment of the neighbourhood or industrialisation of the surrounding area) or a change in legislation on living standards (energy performance, anti-pollution standards, etc.). In such cases, the value of the property depreciates and the capital invested in it is no longer guaranteed.

As for gold and precious metals in general, everything will depend on how they are kept, bearing in mind that such assets are coveted and can therefore be stolen, resulting in a total loss of capital. But it can also happen that, in the case of coins in particular, and more especially those that have been acquired with a premium linked to their condition (new, corner jewel, splendid, etc.), poor storage conditions lead to a deterioration in their general appearance (scratches, wear, impact marks), drastically reducing their market value and at the same time causing a more or less significant loss of the corresponding capital.

All these risks no longer exist when you use an intermediary like VeraCash, whose priority is to prevent the precious metals held by its customers from deteriorating. With more than 6 tonnes of gold and 55 tonnes of silver managed by the AuCOFFRE group, VeraCash is one of Europe’s leading buyers of precious metals, taking care not only of their safekeeping but also of their protection in the vaults of the Ports Francs et Entrepôts de Genève (PFEG), one of the most secure locations in the world. As for the availability of converted capital, here again VeraCash offers one of the best solutions on the market, thanks to a payment card directly linked to each customer’s account, giving them an immediate means of payment for all their day-to-day purchases.

Of course, there remains the risk of Veracash going out of business or going bankrupt, but in that case all the coins and bullion held at the Geneva Free Ports and in France would be sold at the market price, so that each customer would receive back the full value of his or her capital in precious metals, depending on the gold price at the time of resale.

As a result, even if some assets are more protective than others, the total absence of risk can never be guaranteed. That said, a good investment strategy consists first and foremost of diversifying your savings, if possible by combining secure investments (Livret A, LDD, safe havens) to protect part of your capital, and riskier products (with potentially higher returns) to boost your assets. It’s up to each investor to find the level of risk they are prepared to accept in relation to the expected gains.

Auteur et consultant depuis plus de vingt ans dans le domaine de la communication stratégique, il a plusieurs fois travaillé pour le compte d'entreprises financières dont il décrypte aujourd'hui les coulisses et les mécanismes économiques de base à l'intention du plus grand nombre.