Gold’s little cousin seems to be stuck on a plateau crossed in 2020. The year 2022 looked pretty bad without the last quarter’s rally. So, after two years of hesitation, will silver metal finally turn the corner? To the top?

2022: in euros, silver’s performance will differ from that of gold

Those familiar with precious metals know this. Normally, the silver price follows the trends of the gold price. With slightly larger movements but still very similar. In 2022, this was not the case for silver in euros. In summary, silver rose less high and for less time. It fell lower, for longer.

Silver loses and gains

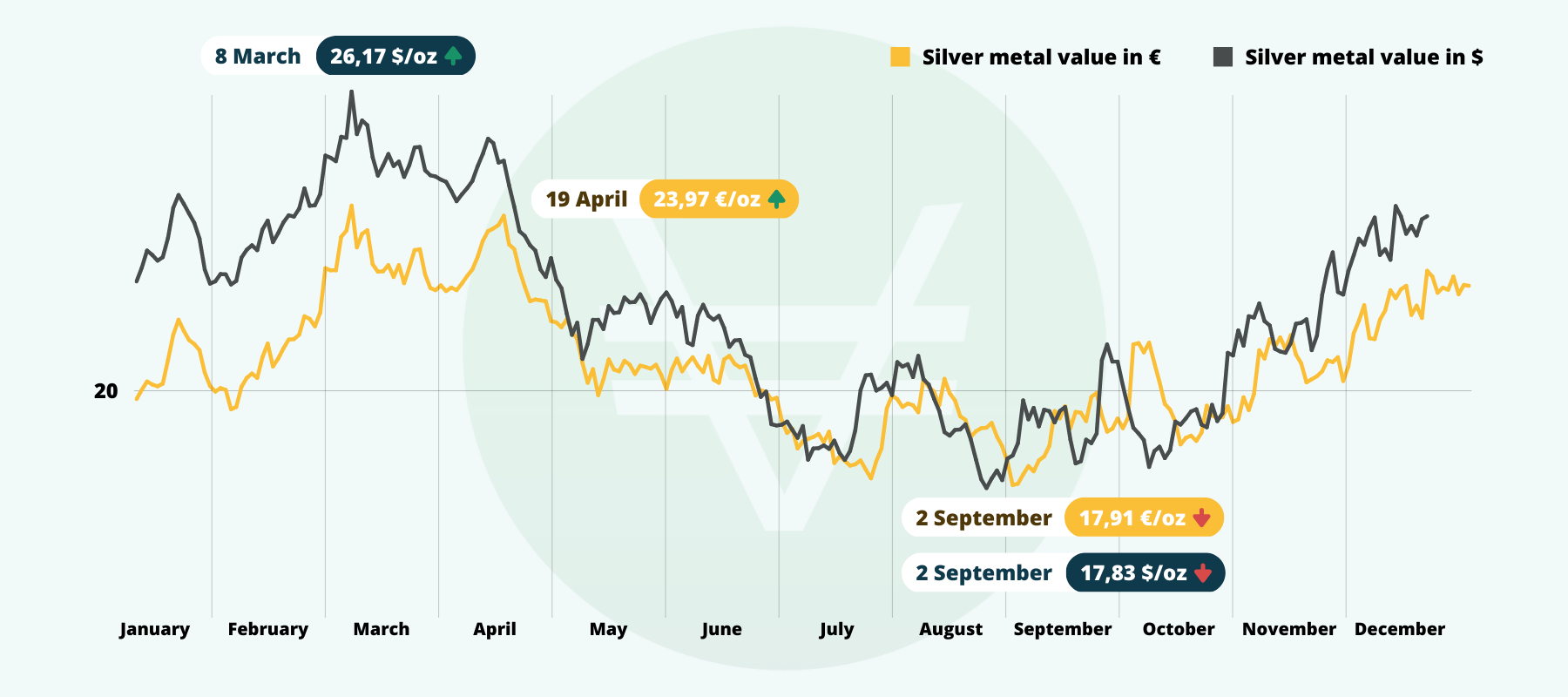

The silver price over one year forms a very pronounced ‘V’.

- The year 2022 began at 20 euros per ounce of silver;

- A high of 24 euros at the start of the war in Ukraine in March;

- A low of 18 euros in September.

- The year ended with an unexpected rise to 22 euros.

10% increase over one year

Finally, over the year 2022, the silver price rose by 10%. This is rather pleasing compared to gold at 6% or the stock markets in the red and real estate which is floundering.

Why is silver struggling in 2022?

As we have seen, at the end of the race, silver is recovering well. But we could have expected other reactions as well.

War outbreak: risk of shortage?

Silver is not a safe haven, it is not gold. On the other hand, it is an industrial asset. With a war on Europe’s doorstep, it is not the fear of conflict that influences silver investors, it is the industrial risk. Will there be a silver shortage? Commodity portfolio managers were quick to answer no to this question: there is no reason for the price to rise.

Industrial risk: lower silver consumption

In fact, it was the threat to the smooth running of factories that worked against silver. This was due to the disruption of logistical flows in Eastern Europe, but also because of the Zero COVID policy that was being pursued in China with numerous confinements. The silver-intensive solar panel and electronics factories were producing less.

Inflation and interest rates: decline in industrial activity

Normally, inflation is rather favourable to the silver price. Prices rise, the economic machine goes into overdrive and the price of silver increases. Except that in 2022, interest rates rose sharply. Access to credit became more difficult for companies and individuals. Investors feared a drop in industrial production, a slowdown in the economy or even a recession. And thus, industrial commodities including silver are impacted. A decrease in demand causes a drop in prices.

2023: silver’s revival?

For years, many investors have believed that silver is underpriced. Recently, there have been attempts to short squeeze silver by people on the internet.

The unfavourable gold/silver ratio

For them, as for many white metal lovers, the gold/silver ratio is too unfavourable to silver. It is not at its fair value. This ratio is based on the volumes of gold and silver mined (ratio of 1 to 15). But today, recycling is so developed that the ratio is no longer relevant.

The energy transition in full swing

Another argument is put forward. The role of silver metal in the energy transition. It is found in particular in photovoltaic panels. With the rising cost of fossil fuels (gas, oil) and global warming, governments are pushing individuals and companies to install solar panels. Demand will explode, as will the demand for money. This is undoubtedly the indicator to follow in the year 2023.

I have been a web entrepreneur since 1999. After graduating from the Bordeaux School of Journalism, I was a radio reporter for 10 years. I run several social media and blogs on business, tech, finance and digital marketing.

You might be interested in

4 May 2023

How much should I spend on gold and silver?

Diversifying is about minimising the risk of capital losses that are always possible on certain products, but also and above all, to preserve the…

22 November 2021

Gold and silver: modern payment methods?

Can we use gold and silver as currency nowadays, even though our spending habits are becoming increasingly electronic with cashless trades? Yes,…

23 January 2020

Nine Good Reasons to Invest in Silver

Is silver a good investment? Is this a good time to buy? How do I invest in silver? These are just some of the questions that may come to mind when…